Advertisement

Simple Introduction TaxTim SA

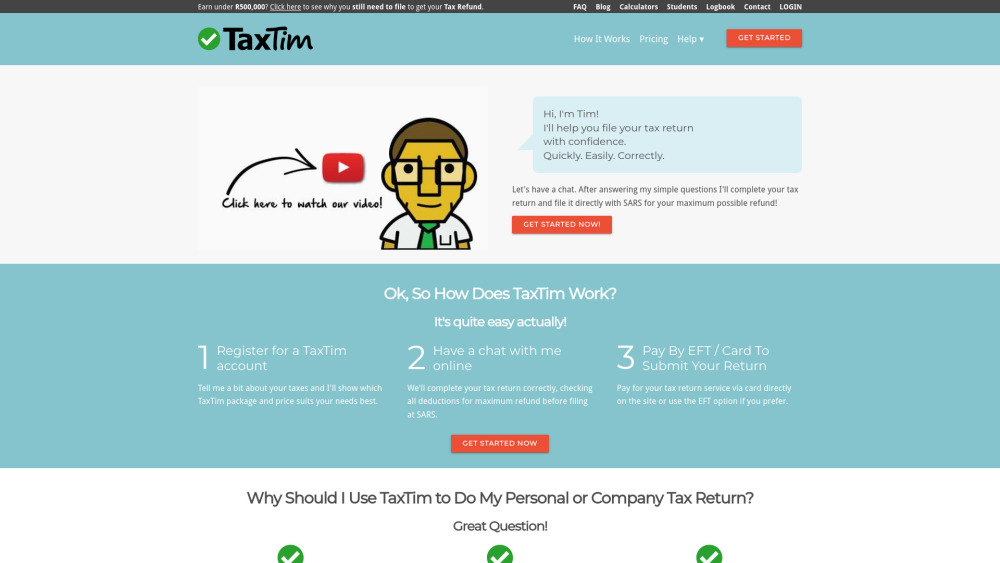

TaxTim SA revolutionizes South African tax filing through intelligent automation and user-friendly guidance.

Discover The Practical Benefits

TaxTim SA represents a breakthrough in digital tax solutions for South African residents, combining artificial intelligence with intuitive design to transform tax compliance. The platform's sophisticated algorithms analyze users' financial data to maximize deductions while ensuring full compliance with SARS regulations. After account creation, users are guided through a structured interview process where the AI dynamically adjusts questions based on previous responses. The system automatically categorizes income sources, identifies eligible expenses, and flags potential audit risks. Document verification uses machine learning to detect inconsistencies or missing information. A unique feature is the virtual tax assistant that provides contextual help throughout the filing process, explaining complex tax concepts in simple terms. The platform maintains a complete audit trail and stores submitted documents securely for seven years as required by law. For complex cases, TaxTim SA offers tiered assistance levels from basic automated filing to full accountant review. The mobile app includes biometric login and push notifications for filing deadlines. Post-submission, the platform tracks refund status and provides year-round tax planning advice based on life changes. By demystifying tax compliance, TaxTim SA empowers users to file accurately while optimizing their financial position.

Advertisement

Probationer

Salaried employees

Automates PAYE reconciliation and medical aid claims

Freelancers and contractors

Simplifies expense tracking and provisional tax calculations

Property investors

Calculates complex rental income deductions accurately

Expatriates

Handles foreign income reporting and tax treaties

Key Features: Must-See Highlights!

AI-Powered Deduction Finder:

Automatically identifies all eligible tax deductions and creditsSmart Document Verification:

Machine learning checks uploaded documents for completenessVirtual Tax Assistant:

24/7 chatbot explains tax concepts and answers questionsMobile Filing Convenience:

Full functionality available through iOS and Android appsReal-Time Audit Risk Assessment:

Flags potential issues before submission to SARSAdvertisement

visit site

FAQS

How does TaxTim SA ensure my tax return is accurate?

The platform uses multiple validation layers including AI cross-checks against SARS guidelines, historical data patterns, and document verification to minimize errors before submission.

Can I use TaxTim SA if I have multiple income sources?

Yes, the system is designed to handle complex financial situations including rental income, freelance work, investments, and foreign income with appropriate SARS disclosure forms.

What happens if SARS audits my return?

TaxTim SA provides full audit support including access to your filing history, document copies, and guidance on responding to SARS queries at no additional cost.

Top AI Apps

Related AI Apps